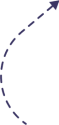

Turning 30 marks an exciting new chapter, but for many, it’s also the moment when debt and financial anxiety start to feel overwhelming. Maybe you’re balancing student loans with a new mortgage. Maybe you’re juggling childcare costs, family obligations, or unpaid medical bills.

These burdens can seep into every aspect of daily living: late-night worries, strained relationships, and feelings of failure each time a bill arrives. Financial anxiety isn’t just about money—it’s about hope, stability, and peace of mind.

It can be hard to talk openly about the struggle. Shame, fear, or a desire to look successful to others often leads to silence.

This blog aims to break that silence, offering compassionate guidance on managing debt, establishing an effective debt management plan, supporting family debt management, and—above all—discovering the meaning and management of financial anxiety.

Whether your goals include freedom from stress or a more stable future for your loved ones, you’re not alone. There’s always a way forward.

What is Debt Management?

What you'll Learn

ToggleDebt management is the conscious process of organizing, prioritizing, and reducing your financial obligations so you can regain control of your money and future.

At its core, a debt management plan isn’t just a budget—it’s a long-term commitment to building confidence, stability, and resilience as you move through adulthood.

There are many myths about debt management, especially for people in their 30s.

Some believe only the deeply indebted need help. Others fear that enrolling in a program means admitting failure. The truth is that managing debt effectively is for anyone who wants to replace chaos with clarity.

It means identifying which debts cost you most, negotiating better rates, setting manageable payments, and learning new habits around spending and saving.

Debt isn’t always “bad.” Learning to distinguish between healthy investments (such as a mortgage or business loan) and high-interest liabilities (such as credit card balances or payday loans) is critical. With every step in managing debt, you strengthen your capacity for bigger life goals—whether buying a home, starting a family, or launching a business.

Debt Management Plans and Strategies

A debt management plan gives structure and predictability to your financial journey. Two popular, proven debt management strategies are the snowball and avalanche methods.

The debt snowball method focuses on paying off your smallest balances first, giving psychological wins and momentum to keep going.

The debt avalanche method prioritizes debts with the highest interest rates, which saves you more money in the long run—even if the victories take longer to arrive.

Creating a sustainable debt management plan begins with listing each current loan, bill, and overdue payment alongside interest rates and minimum payments.

Consider debt consolidation if your credit score qualifies for a lower interest rate—rolling several debts into a single payment can be a lifesaver.

For student loans or high-interest car loans, refinancing may offer relief.

A few more debt management strategies:

Automate all payments so nothing falls through the cracks.

Make debt payoff a top priority in your monthly budget, not just an afterthought.

Contact creditors early if you sense trouble; many offer hardship programs or restructuring options.

Managing debt effectively in your 30s means tracking your progress, celebrating every milestone, and directing freed-up funds toward building an emergency cushion or growing investments. The earlier you take action, the more options you’ll have for future financial freedom.

Family Debt Management: Challenges and Solutions

Managing debt effectively isn’t just a solo challenge—it often impacts spouses, partners, children, and aging parents. Family debt management means juggling competing priorities, emotional needs, and unexpected costs.

The most common pain points are:

Different financial habits and attitudes between partners.

Children’s education, health, and activity costs that fluctuate unexpectedly.

Supporting parents or siblings through unemployment or medical emergencies.

The key to family debt management is open, compassionate communication. Schedule monthly budget meetings where everyone can share concerns and set priorities. Visual tools—like charts showing debt payoff progress—can make the process feel less stressful. Create clear boundaries between shared and individual expenses; define which debts are everyone’s responsibility to avoid misunderstandings.

Prioritize essential needs over fleeting wants, and agree on long-term financial goals, such as buying a home or creating a family emergency fund.

It’s not always easy, and there may be conflict. But facing financial anxiety together, using debt management strategies everyone understands, builds trust and resilience—both financially and emotionally.

Financial Anxiety: Defining and Identifying Symptoms

Financial anxiety is more than just “worrying about money.” It’s an ongoing, sometimes crippling sense of fear, shame, or stress that affects sleep, decision-making, and your capacity to enjoy life. But what is financial anxiety in practical terms?

Symptoms might include:

Chronic sleeplessness or waking in the night thinking about bills.

Difficulty focusing at work or home because of constant financial stress.

Physical signs, such as headaches, rapid heartbeat, or stomach aches when reviewing budgets.

Avoiding money matters: ignoring bank statements, letting bills pile up, putting off uncomfortable conversations.

Feeling irritable or frightened during family discussions about money.

These symptoms can develop when you lack control, feel overwhelmed by obligations, or are haunted by past missteps.

Financial anxiety symptoms are widespread; even people who appear secure are carrying invisible burdens.

Recognizing anxiety and financial stress is the first, crucial step towards relief.

How to Deal With Financial Anxiety

If you’re wondering how to deal with financial anxiety, it begins with empathy and practical action.

First, acknowledge your emotions. Shame and guilt serve no purpose in debt management—everyone struggles at some point. Inventory all debts and expenses, bringing hidden stressors to light.

Break goals into manageable steps. Instead of “fix everything,” aim to pay down a specific credit card or save a modest emergency fund. Budget with compassion and realism—avoid dramatic, unsustainable cuts.

Automate payments for peace of mind and track your spending with user-friendly apps or notebooks.

Professional support is invaluable. Financial counselors offer unbiased advice and workable plans. Therapists or support groups can help you address anxiety and financial stress holistically.

Practice mindfulness. Deep breathing, meditation, or journaling help anchor you when stress flares.

Prioritize routine sleep, nutrition, and exercise—all foundational to emotional resilience.

Finally, celebrate every milestone. Even paying off a single debt or sticking to a budget for a month deserves recognition.

The journey is incremental, and dealing with financial anxiety is about building confidence with every small step.

Real-Life Stories: Navigating the Pain Points

Sam’s Story

Sam felt crushed by student loans after graduation. Every bill triggered shame and insomnia. When Sam finally listed every debt—including the small ones—and tackled the lowest balance first, it was a turning point. Each paid-off loan brought renewed hope and energy. The day Sam made the final payment felt liberating, proof that small steps lead to real freedom.

Priya’s Journey

Priya balanced caring for two young children, a spouse, and a parent battling illness—all on a modest salary. Debt talks with her partner were tense, sometimes tearful. Monthly family budget sessions transformed fear into unity. By clarifying priorities, setting boundaries, and celebrating debt management wins together, she discovered strength she never knew she had.

These human stories show that debt management isn’t just about numbers—it’s about resilience, trust, and reclaiming peace of mind.

FAQs

Q1: What is debt management and why does it matter in your 30s?

Debt management means making a plan to pay down what you owe and avoid future stress. It gives you flexibility for investments, family needs, and emergencies.

Q2: How do I start a debt management plan?

List every debt, pick a strategy (snowball/avalanche), automate payments, and review progress monthly. Honesty is essential for real success.

Q3: What are signs of financial anxiety?

Sleeplessness, avoidance, restlessness, physical symptoms, and irritability in money conversations are key signals.

Q4: How can I discuss family debt management calmly?

Schedule honest, routine talks. Create visual progress trackers and ground rules for shared expenses. Empathy goes a long way.

Q5: Which debt management strategies are best?

Snowball (smallest balance first) builds motivation; avalanche (highest interest first) saves money. Combine with consolidation if you qualify.

Q6: Can financial anxiety be overcome?

Absolutely. With therapy, financial counseling, mindfulness, and practical steps, recovery is possible. Community helps too.

Q7: Is budgeting enough to solve financial stress?

Budgeting is foundational. For persistent anxiety, seek professional help and combine financial steps with emotional support.

Q8: How is family debt management different?

It’s more complex—requires shared priorities and clear communication. The emotional stakes are much higher.

Q9: Where can I find help for debt or anxiety?

Start with financial advisors or credit counselors. Community organizations, online tools, and peer support also offer guidance.

Q10: What if nothing I try helps my financial stress?

Turn to professional mental health and financial experts. There’s always help available—no one should battle alone.

Conclusion & Next Steps

Managing debt and financial anxiety in your 30s is a steep hill, but every small step upward leads to lasting peace, stability, and hope. With honesty, a clear debt management plan, open family dialogue, and practical strategies, you can reclaim control.

A future free from anxiety and unmanaged debt is possible—and you don’t have to make the journey alone. Take your first step today, and every victory, no matter how minor, strengthens your tomorrow